- Second quarter 2021 revenue of $949.0 million, and net income of $61.0 million, or $2.27 per diluted share. On a non-GAAP1 basis, second quarter 2021 net income of $53.1 million, or $1.97 per diluted share.

- Highest quarterly revenue and operating income in ArcBest's history.

FORT SMITH, Ark., Aug. 2, 2021 /PRNewswire/ -- ArcBest® (Nasdaq: ARCB), a leader in supply chain logistics, today reported second quarter 2021 revenue of $949.0 million compared to second quarter 2020 revenue of $627.4 million. ArcBest's second quarter 2021 operating income was $74.3 million and net income was $61.0 million, or $2.27 per diluted share compared to second quarter 2020 operating income of $20.4 million and net income of $15.9 million, or $0.61 per diluted share.

Excluding certain items in both periods as identified in the attached reconciliation tables, non-GAAP operating income was $74.8 million in second quarter 2021 compared to second quarter 2020 operating income of $25.1 million. On a non-GAAP basis, net income was $53.1 million, or $1.97 per diluted share in second quarter 2021 compared to second quarter 2020 net income of $17.6 million, or $0.67 per diluted share.

‘We're very pleased to report record results for the second consecutive quarter, „said Judy R. McReynolds, ArcBest chairman, president and CEO. ‘Our strong results for the first half of 2021 reflect our tireless execution in a period of extremely tight capacity and high demand. We put the customer at the center of everything we do, and we're seeing our approach pay off as we work alongside shippers and capacity providers to solve their complex challenges.”

Second Quarter Results of Operations Comparisons

Asset-Based

Second Quarter 2021 Versus Second Quarter 2020

• Revenue of $652.8 million compared to $460.1 million, a per-day increase of 41.9 percent.

• Total tonnage per day increase of 22.7 percent, with double-digit percentage increases in both LTL-rated tonnage and TL-rated spot shipment tonnage moving in the Asset-Based network.

• Total shipments per day increase of 13.5 percent including a 13.7 percent increase in LTL-rated shipments per day and an increase of 10.8 percent in LTL-rated weight per shipment.

• Total billed revenue per hundredweight increased 15.4 percent and was positively impacted by higher fuel surcharges. Revenue per hundredweight on LTL-rated business, excluding fuel surcharge, improved by a percentage in the mid-single digits.

• Operating income of $63.9 million and an operating ratio of 90.2 percent compared to the prior year quarter operating income of $21.0 million and an operating ratio of 95.4 percent. On a non-GAAP basis, operating income of $71.4 million and an operating ratio of 89.0 percent compared to the prior year quarter operating income of $25.8 million and an operating ratio of 94.4 percent.

ArcBest's Asset-Based business continued to benefit from increasing customer demand and a solid pricing environment that contributed to record-setting revenue and profits. This quarter's results compared favorably to the second quarter of 2020 which was significantly impacted by the COVID-19 pandemic. Considering the strength of business from core customers, along with unseasonable demand for household goods moving services which was earlier in the year than normal, Asset-Based shipment mix was managed for customer service levels, while optimizing revenue. In response to the need for increased use of local and linehaul purchased transportation to supplement the Asset-Based network and meet customers' needs, second quarter hiring initiatives were successful and should produce future benefits.

Closing Comments

‘We are experiencing a strong start to 2021 and I'm proud of the work our leaders and employees are doing on behalf of our customers as their businesses normalize, „McReynolds said. ‘Providing assured capacity is a shared mindset of employees across our organization.”

https://www.prnewswire.com/news-rele...301345733.html

- Highest quarterly revenue and operating income in ArcBest's history.

FORT SMITH, Ark., Aug. 2, 2021 /PRNewswire/ -- ArcBest® (Nasdaq: ARCB), a leader in supply chain logistics, today reported second quarter 2021 revenue of $949.0 million compared to second quarter 2020 revenue of $627.4 million. ArcBest's second quarter 2021 operating income was $74.3 million and net income was $61.0 million, or $2.27 per diluted share compared to second quarter 2020 operating income of $20.4 million and net income of $15.9 million, or $0.61 per diluted share.

Excluding certain items in both periods as identified in the attached reconciliation tables, non-GAAP operating income was $74.8 million in second quarter 2021 compared to second quarter 2020 operating income of $25.1 million. On a non-GAAP basis, net income was $53.1 million, or $1.97 per diluted share in second quarter 2021 compared to second quarter 2020 net income of $17.6 million, or $0.67 per diluted share.

‘We're very pleased to report record results for the second consecutive quarter, „said Judy R. McReynolds, ArcBest chairman, president and CEO. ‘Our strong results for the first half of 2021 reflect our tireless execution in a period of extremely tight capacity and high demand. We put the customer at the center of everything we do, and we're seeing our approach pay off as we work alongside shippers and capacity providers to solve their complex challenges.”

Second Quarter Results of Operations Comparisons

Asset-Based

Second Quarter 2021 Versus Second Quarter 2020

• Revenue of $652.8 million compared to $460.1 million, a per-day increase of 41.9 percent.

• Total tonnage per day increase of 22.7 percent, with double-digit percentage increases in both LTL-rated tonnage and TL-rated spot shipment tonnage moving in the Asset-Based network.

• Total shipments per day increase of 13.5 percent including a 13.7 percent increase in LTL-rated shipments per day and an increase of 10.8 percent in LTL-rated weight per shipment.

• Total billed revenue per hundredweight increased 15.4 percent and was positively impacted by higher fuel surcharges. Revenue per hundredweight on LTL-rated business, excluding fuel surcharge, improved by a percentage in the mid-single digits.

• Operating income of $63.9 million and an operating ratio of 90.2 percent compared to the prior year quarter operating income of $21.0 million and an operating ratio of 95.4 percent. On a non-GAAP basis, operating income of $71.4 million and an operating ratio of 89.0 percent compared to the prior year quarter operating income of $25.8 million and an operating ratio of 94.4 percent.

ArcBest's Asset-Based business continued to benefit from increasing customer demand and a solid pricing environment that contributed to record-setting revenue and profits. This quarter's results compared favorably to the second quarter of 2020 which was significantly impacted by the COVID-19 pandemic. Considering the strength of business from core customers, along with unseasonable demand for household goods moving services which was earlier in the year than normal, Asset-Based shipment mix was managed for customer service levels, while optimizing revenue. In response to the need for increased use of local and linehaul purchased transportation to supplement the Asset-Based network and meet customers' needs, second quarter hiring initiatives were successful and should produce future benefits.

Closing Comments

‘We are experiencing a strong start to 2021 and I'm proud of the work our leaders and employees are doing on behalf of our customers as their businesses normalize, „McReynolds said. ‘Providing assured capacity is a shared mindset of employees across our organization.”

https://www.prnewswire.com/news-rele...301345733.html

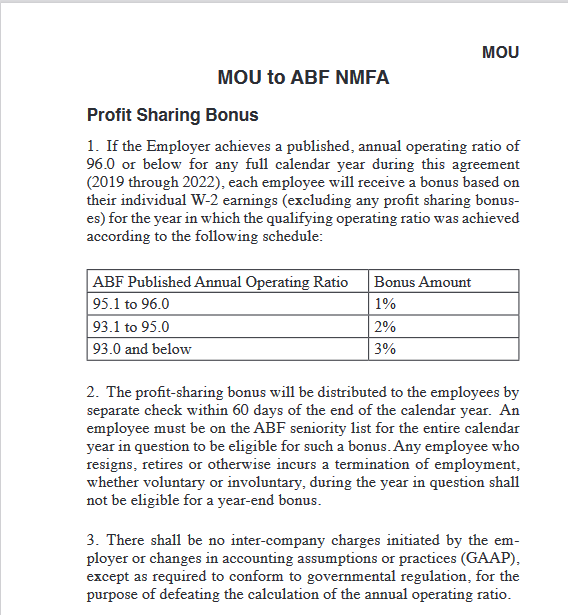

The question is... will Judy find a way to screw you guys out of it? After all... she's the one who believes that an uneducated truck driver shouldn't be making $100,000 a year and that would really stick in her craw to hand you over another 3%. She may be a creative wizard when it comes to manipulating the books so that actually might be a challenge to keep you from getting at least 2%... unless something drastically happens during the remainder of the year seeing that ArcBest had two record breaking quarters in a row.

Comment